Table of Content

Be sure to have a debt payoff plan in place before you sign on to a deferred interest financing offer with the Synchrony HOME card. The card charges a whopping 29.99% fixed APR, which is almost double the average credit card interest rate. Indeed, 29.99% is high even compared to the rate you’ll find on many credit cards designed for people with bad credit. The catch is that you won’t earn any cash back on purchases over $299.

The Synchrony HOME Credit Card is accepted at thousands of locations nationwide and home-related stores online. To find physical store locations near you that accept the card, visit our store locator. With the Synchrony Home card, customers can shop at hundreds of affiliated retailers nationwide. They also have the possibility to participate in discounts and promotions specially designed for them. If you are a new beneficiary and still don’t know which stores accept the Synchrony credit card, we’ll tell you briefly. Our editorial team and expert review board work together to provide informed, relevant content and an unbiased analysis of the products we feature.

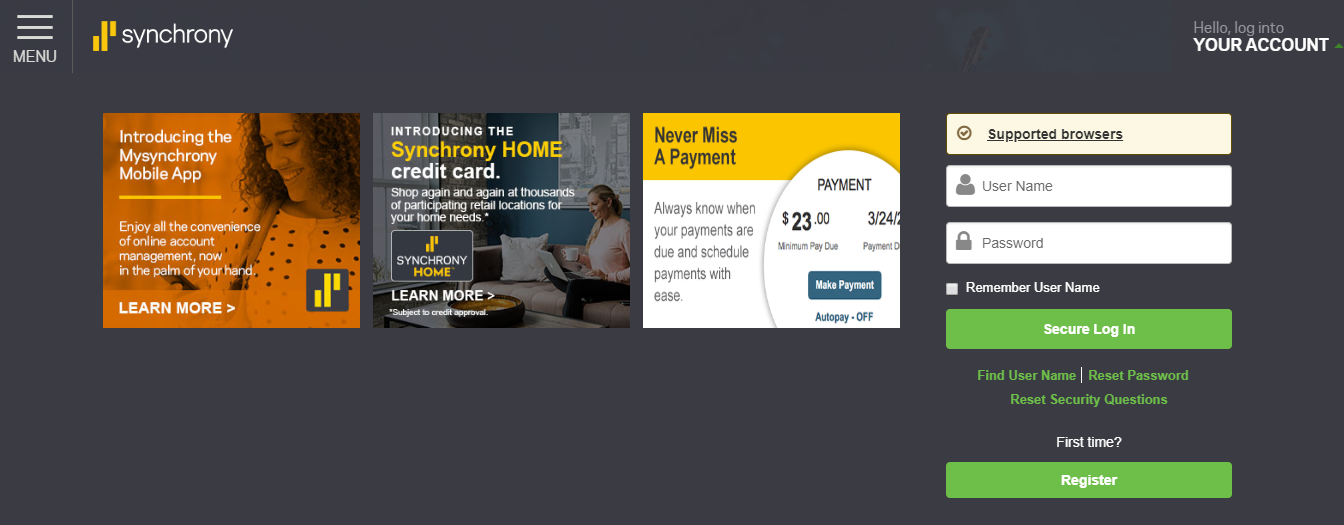

How to apply for a Synchrony Bank card

Nouri Zarrugh is a staff writer and editor at CreditCards.com and Bankrate Credit Cards, focusing on product news, reviews and recommendations. His areas of expertise include credit card strategy, rewards programs, point valuation and credit scores, and his stories on building credit have been cited by Mic.com, LifeHacker, People.com and more. Also a fiction writer, he won the Keene Prize for Literature and holds an MFA in creative writing from the Michener Center for Writers at the University of Texas at Austin. You can also use the card with participating service providers like carpet installers and home repair specialists.

A less risky approach may be to open a new credit card that offers a 0% introductory APR on purchases. Traditional cash back cards don’t usually limit on the amount of cash back you can earn in this way. The Citi® Double Cash Card, for example, offers up to 2% cash back on every purchase (1% when you buy and 1% when you pay off those purchases), no matter where you buy or how much you spend. At the payment page, look for the option to pay with a "Synchrony HOME" Credit Card. Enter your Synchrony HOME Credit Card account number when prompted.

Where to use the Synchrony HOME card

Submit When you click “Submit,” you will be signed into Mover Hub by Synchrony HOME™ and given access to gated content. Select a category below to refine your search and click on Find Locations. Synchrony Car Care™Manage all your car expenses — gas, tires, repairs and maintenance — with one card.

Keep reading to learn more about the store cards it issues – and whether one of them could be right for you. The card also offers deferred interest for purchases paid in full within 6 months of account opening. We’re sorry, but something went wrong and we couldn’t find your approval odds. Instead, you’ll see recommended credit ranges from the issuers listed next to cards on our site to help you determine which cards you’re likely to be approved for. CreditCards.com credit ranges are derived from FICO® Score 8, which is one of many different types of credit scores.

Synchrony HOME Locations

Instead, larger purchases are eligible for promotional financing. This means that unless you frequently make smaller purchases with the Synchrony HOME card’s partner retailers, the card is unlikely to offer much rewards value in the long run. 12-to-60-months promotional financing on qualifying purchases at thousands of participating Synchrony HOME locations nationwide. Everywhere your Synchrony HOME Credit Card is accepted, the 6 month promotional financing offer will automatically be applied to purchases of $299 or more. You can make a Synchrony Bank credit card payment online, over the phone, or by mail with a check or money order.

ADVERTISER DISCLOSURE CreditCards.com is an independent, advertising-supported comparison service. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear within listing categories. Other factors, such as our proprietary website's rules and the likelihood of applicants' credit approval also impact how and where products appear on the site. With the new Synchrony HOME Credit Card, purchases of $299 or more will receive 6 months promotional financing, everywhere the card is accepted 1 in stores and online. The easiest way to apply for Synchrony Bank credit cards is online. Go to MySynchrony.com, then click “Where to Shop” at the top of the page.

Synchrony Home Credit Card's Additional Info

CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Stay on top of industry trends and new offers with our weekly newsletter. Keep an eye on MySynchrony.com to see if you can find additional discounts and financing options. We can help you manage health and wellness costs with financing for healthcare, dental and vision. If you have a large or routine purchase to make, we have the financing solutions that can help fit it into your budget. Find the businesses with financing options that are right for you.

On At Home purchases with the At Home Insider Perks® credit card. We work hard to show you up-to-date product terms, however, this information does not originate from us and thus, we do not guarantee its accuracy. When you click "Apply Now" you will be directed to the offering institution's website.

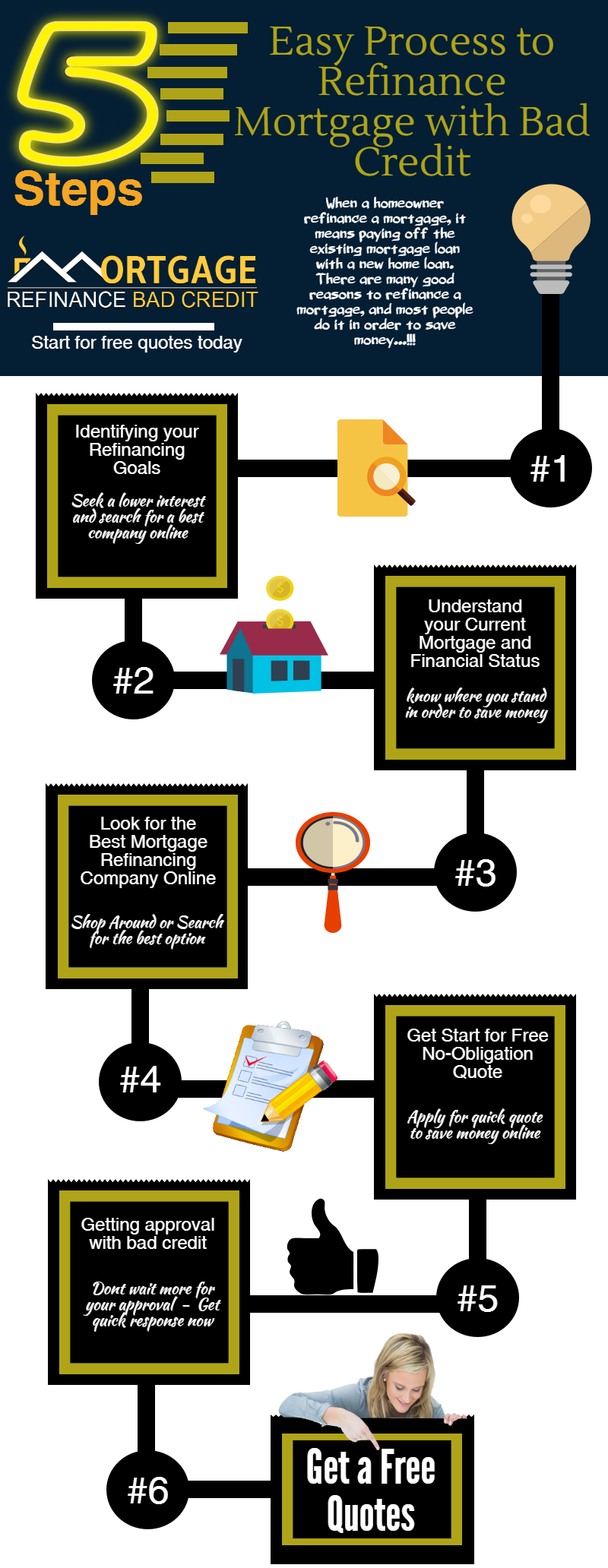

You can search for a specific retailer, browse through the bank’s partnering stores or filter cards by shopping category, such as home furnishings or sporting goods. If you find a card you’re interested in, click “Apply” and supply the requested information. In place of cash back rewards, the Synchrony HOME card automatically gets you 6 months of deferred interest financing on purchases of $299 or more. Your purchases may also qualify for a deferred interest financing period of 12 to 60 months, depending on the promotions the retailer is currently offering. At thousands of “Synchrony HOME locations,” your purchase may also qualify for months promotional financing, 1 depending on the offers currently available at these participating retailers. Between high interest rates and confusing deferred-interest promotions, you could find yourself deep in debt if you’re not careful.

12 to 60 months of promotional financing on qualified purchases at certain locations. The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers.