Table of Content

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considered as a basis for repaying a loan. Increase non-taxable income or benefits included by 25%.

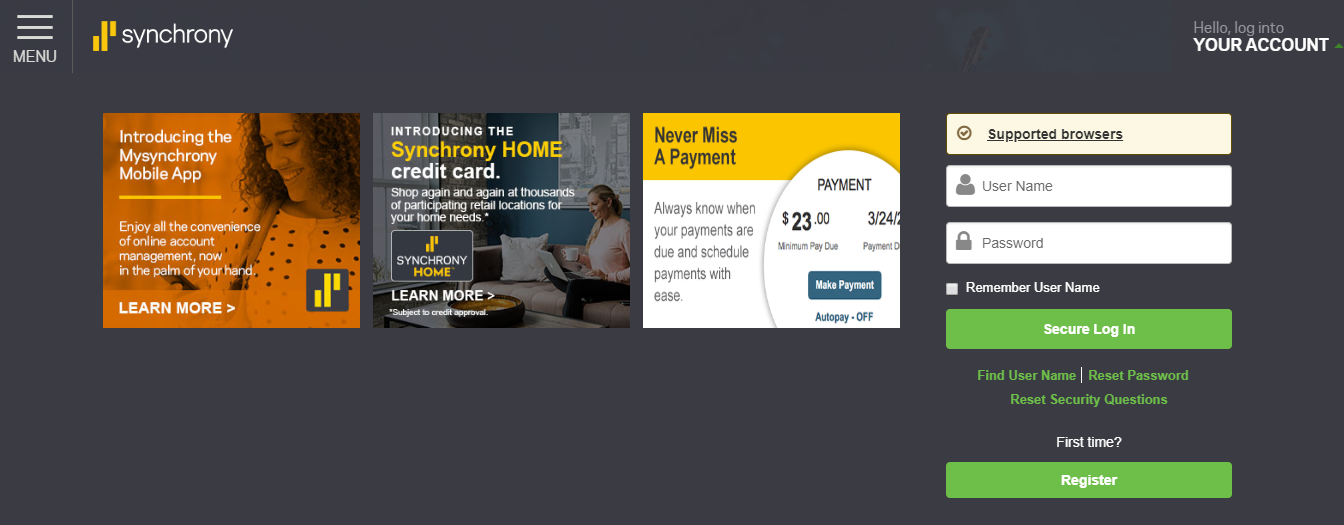

A less risky approach may be to open a new credit card that offers a 0% introductory APR on purchases. Traditional cash back cards don’t usually limit on the amount of cash back you can earn in this way. The Citi® Double Cash Card, for example, offers up to 2% cash back on every purchase (1% when you buy and 1% when you pay off those purchases), no matter where you buy or how much you spend. At the payment page, look for the option to pay with a "Synchrony HOME" Credit Card. Enter your Synchrony HOME Credit Card account number when prompted.

Explore Featured Retailers

Get the chance to enter exclusive gift card sweepstakes & special giveaways. With a full line of financing solutions, we're the partner that can satisfy the unique needs of merchants and consumers. Your cash back is unlimited and gets credited to your statement every month, automatically. Only earns cash back on purchases of less than $299. Whether in-person, in-app or online, a smooth purchasing experience equals a happy customer. The Synchrony HOME Credit Card is issued and serviced by Synchrony Bank.

The editorial content on our site is independent of affiliate partnerships and represents our unique and impartial opinion. Learn more about our partners and how we make money. The "similar styles" price noted is our researched retail price at a point in time of similar style of aesthetic item at another retailer offering home décor products. Like other home décor retailers, we work with a variety of partners to source our products, making each one unique to At Home.

SYNCHRONY HOME™?

WalletHub Answers is a free service that helps consumers access financial information. Information on WalletHub Answers is provided “as is” and should not be considered financial, legal or investment advice. WalletHub is not a financial advisor, law firm, “lawyer referral service,” or a substitute for a financial advisor, attorney, or law firm. You may want to hire a professional before making any decision.

Which typically require you to have an excellent credit history to qualify. Manage multiple promotional financing offers with a single card. Long promotional financing offers, with no interest if balance paid off in full.

60 MONTHS

Nouri Zarrugh is a staff writer and editor at CreditCards.com and Bankrate Credit Cards, focusing on product news, reviews and recommendations. His areas of expertise include credit card strategy, rewards programs, point valuation and credit scores, and his stories on building credit have been cited by Mic.com, LifeHacker, People.com and more. Also a fiction writer, he won the Keene Prize for Literature and holds an MFA in creative writing from the Michener Center for Writers at the University of Texas at Austin. You can also use the card with participating service providers like carpet installers and home repair specialists.

See the online credit card applications for details about the terms and conditions of an offer. Reasonable efforts are made to maintain accurate information. However, all credit card information is presented without warranty. When you click on the "Apply Now" button, you can review the credit card terms and conditions on the issuer's web site. Check the data at the top of this page and the bank’s website for the most current information.

Synchrony’s customers credit card can be used in essential sectors such as automotive, healthcare, construction, home, travel and much more. No matter if it is about changing your car or remodeling your home, with Synchrony credit cards, you have the opportunity to make it happen. Irrespective of whether an offering institution is a paid advertiser, the presence of offer information on WalletHub does not constitute a referral or endorsement of the institution by us or vice versa. Furthermore, offers have not been reviewed or approved by the offering institution.

Most retailers offer furniture, bedding, mattresses, lighting and window treatments. Submit your question about Synchrony Home Credit Card to our community. Editorial and user-generated content is not provided, reviewed or endorsed by the issuer of this card.

You can change your bonus category choice once per calendar month, making the card ideal if your spending habits change from month to month. The Synchrony HOME Credit Card boasts a far wider network of retail partners than the typical store credit card – but its reach is still limited to the home goods and services domain. Widely considered of the best flat-rate cash back cards on the market, the Citi Double Cash card earns up to 2% cash back on all purchases (1% when you buy and 1% when you pay off those purchases). You can use the card anywhere Mastercard is accepted, with no limit on how much cash back you can earn. That said, most credit cards only offer an intro APR period of around 12 to 18 months, which starts when you open your card account – not when you make a purchase. One advantage of a financing tool like the Synchrony HOME card and other installment payment tools is that you may get much more time to chip away at your balance without paying interest.

Paid the account off before the promotional offer ended and before finance charges could be assessed and they reduced my limit to $350 dollars. I had recently charged 300 dollars worth of items comprising of accent pieces just to keep balance from being 0 and lack of use. And my credit score had recently increased by #61 points as I had just come into a little money from my father. They did this years ago when I paid out Belk account with a 6,500 limit.

No comments:

Post a Comment